VETRAN MORTGAGE OPTIONS

WHY CHOOSE US

OUR SERVICES

HOW ITS WORKS

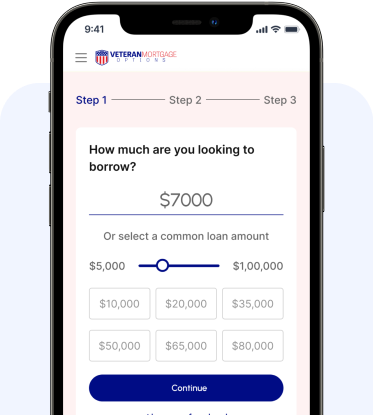

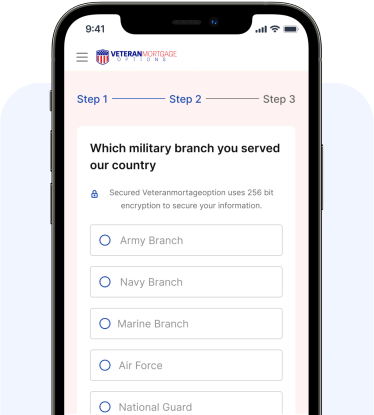

SETP 1

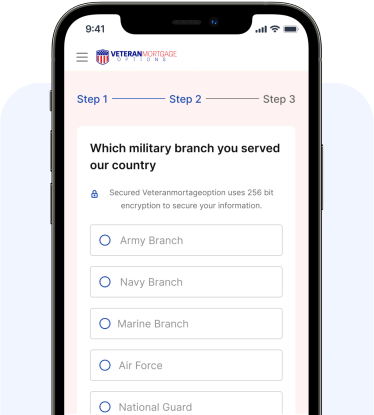

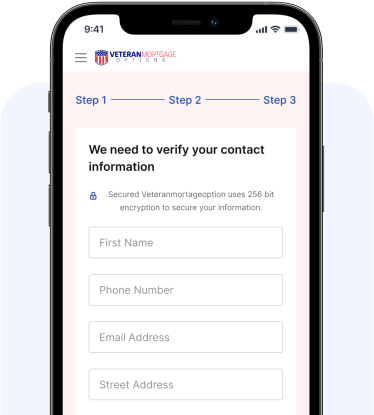

STEP 2

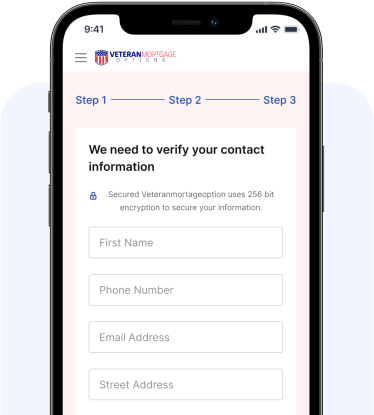

STEP 3

SETP 1

STEP 2

STEP 3

TESTIMONIALS

Victor M

John D

Angelina M

COMMON QUESTIONS